Getting Started #

If you are performing a mid-year conversion, you must load the year-to-date (YTD) AP 1099 totals to account for payments made to your vendors so far.

Template Info #

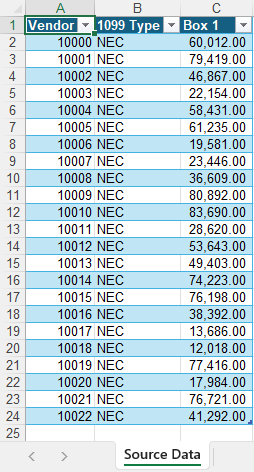

- Required Source Data

- Vendor #

- 1099 Type

- Box 1 Amount

- Additional Tips

- If you need to import amounts other than Box 1, enter them in separate columns that match the Vista layout.

- Basic Steps

- Download TAD Template

- Copy the Source Data

- Import the Records

- Validate Imported Data

Download TAD Template #

Open your source data file in Excel.

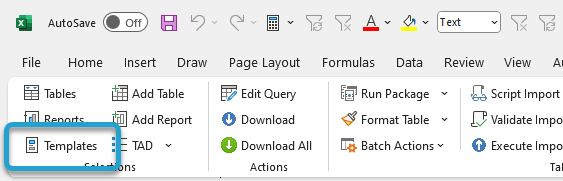

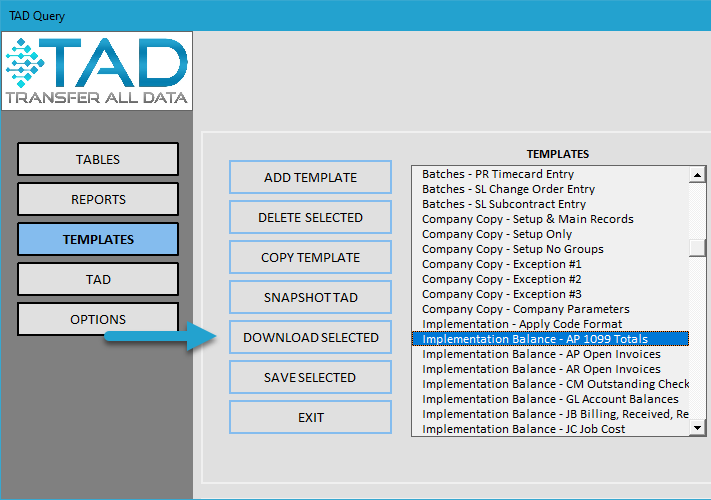

Click the Templates button on the left side of the ribbon.

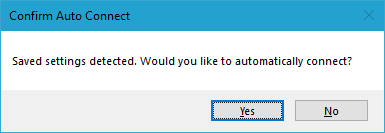

If you’ve signed into TAD before, then you should receive the message below. Click Yes.

If you have not signed into TAD before, follow the Get Connected instructions.

Select the Implementation Balance – AP 1099 Totals template.

Click the Download Selected button.

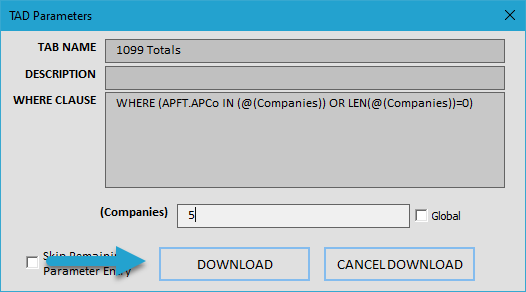

Verify your Company number and click the Download button.

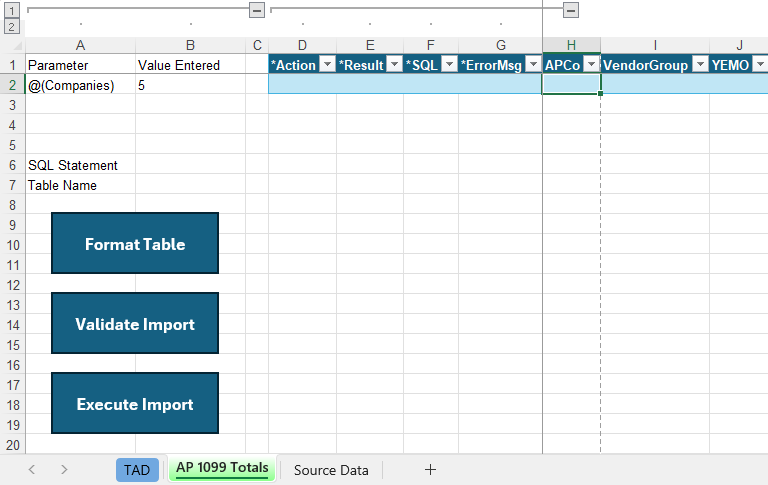

The AP 1099 Totals sheet is used to import the 1099 balances.

Copy the Source Data #

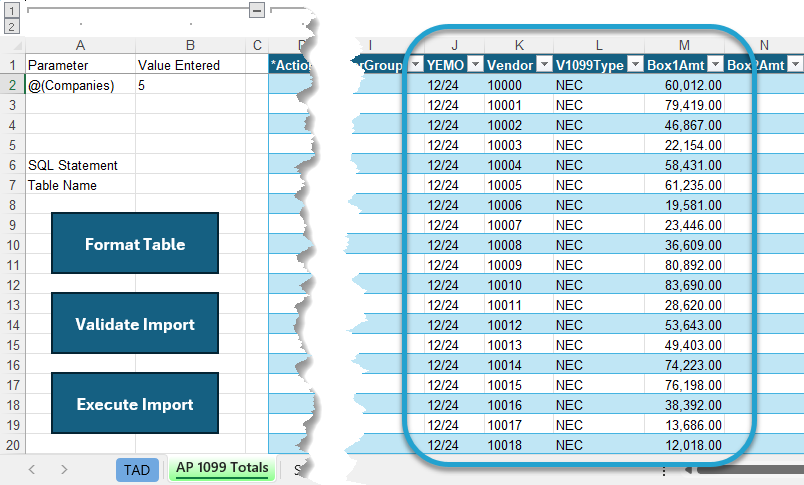

Copy and paste the source data into the AP 1099 Totals sheet. If your source data layout matches the example above, this will be a single copy and paste since the AP 1099 Totals columns are already in the same order.

For the YEMO column, enter 12/XX where XX represents the year you are loading.

Add all other 1099 Types along with their respective Box # Amounts.

Import the Records #

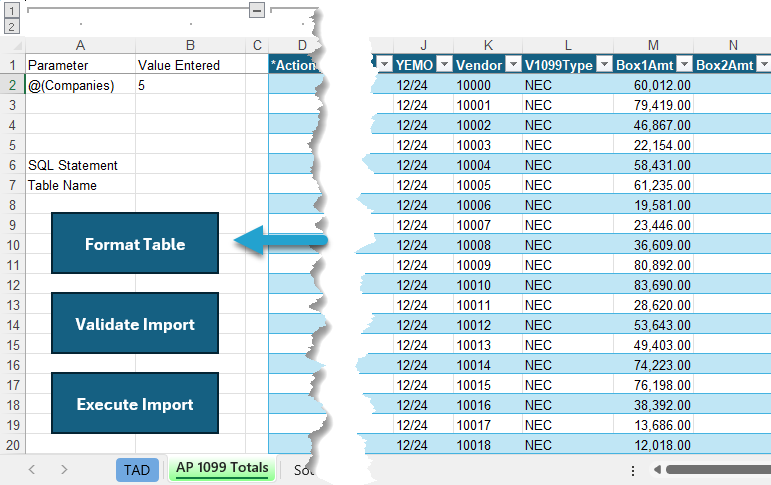

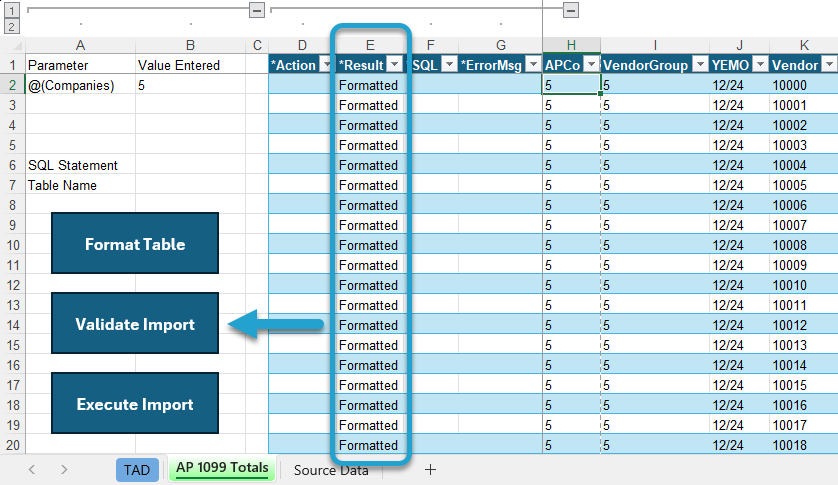

Click the Format Table button to format the data you copied and to apply missing default values.

The *Result column will show Formatted for every record. You will see the default Company number applied.

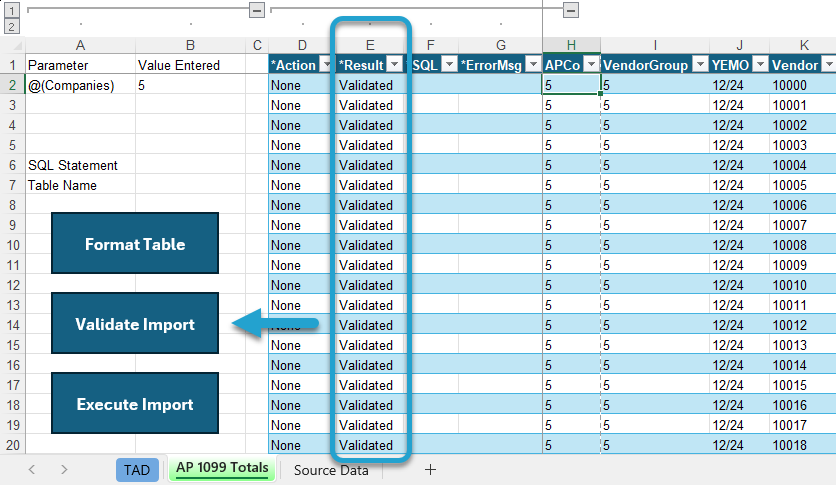

Click the Validate Import button.

The *Result column will show Validated for every record. If this says Failure, then the *ErrorMsg column will provide the error.

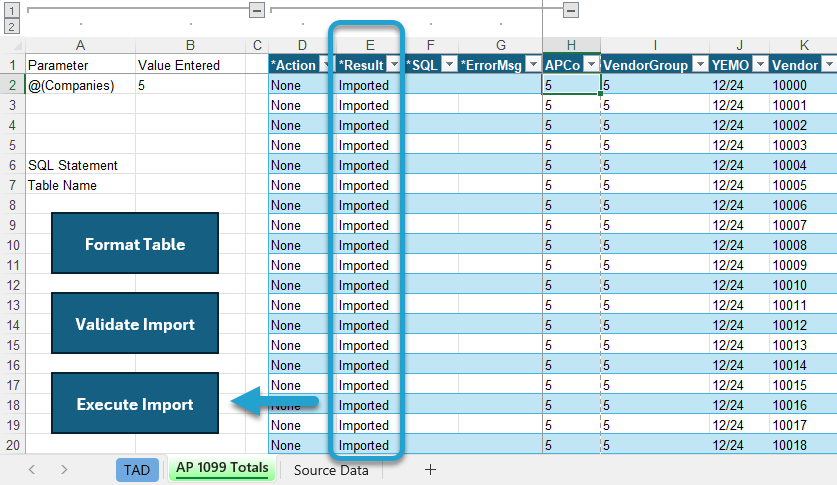

Click the Execute Import button.

The *Result column will show Imported for every record. You can now validate the data in Vista.

Validate Imported Data #

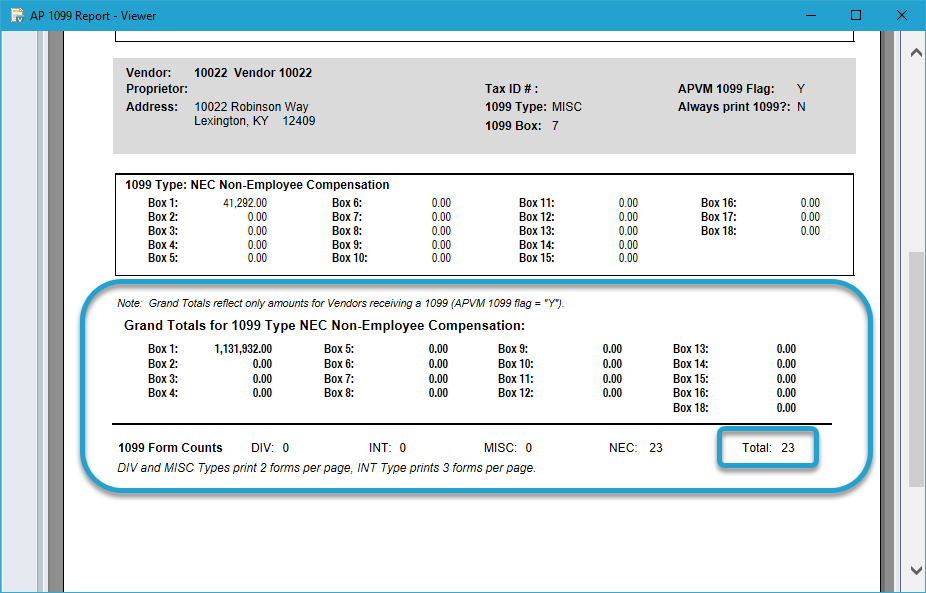

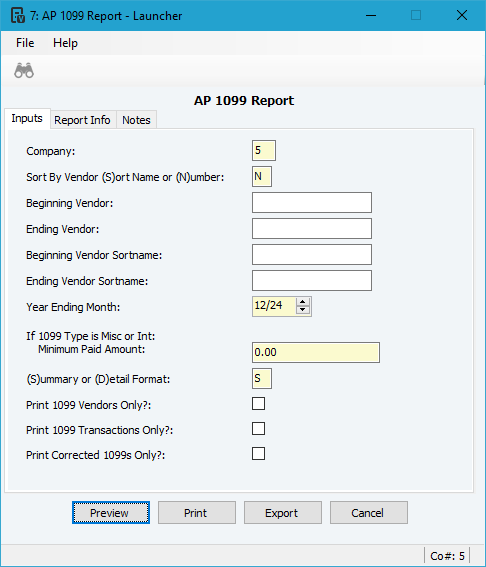

You can validate the 1099 Totals by running the AP 1099 Report report in Vista.

Enter your Company and the Year Ending Month that you just imported.

Make all other parameters look like the image below.

You can validate the grand totals for each 1099 Box and the Total Form Count in the bottom right.